Today we have brought for you the share of a completely new sector, which is constantly being made in the news,

Highlights

we are talking about Vakrangee Ltd, and in this article, we are going to tell you that in the coming times, the share of Vakrangee ltd Which Share Price Target is going to break and in this article you are also going to get

information about Vakrangee Share Price Target 2024, 2025, 2026, 2030, 2040, so please read the article completely. And if you have any complaint or suggestion related to it then share it with us in the comment box.

Vakrangee Share Profile

| Company | Vakrangee Share Price Target |

| Industry | IT Sector |

| Incorporated | 28 May 1990 |

| Listed In | NSE & BSE |

| Website | Click here |

| Our Website Link | Click here |

| Click here to see the Current Share Price | LIVE SHARE PRICE |

Vakrangee Share Price Target

Also Read: HAL Share Price Target

Vakrangee Ltd. is an Indian company working in the IT sector. This company provides many types of services to its customers under one roof, including banking, financial services, insurance, e-governance, e-commerce, logistics, and many types of services are provided and some of this company.

It also provides special services, which include Home loans, Simple Loans, Aadhaar cards, Voter ID Cards, Software and IT Equipment, and E-governance projects in collaboration with the Government of India, which comes under the category of their special services.

To do all these tasks together and in a good way, the company has adopted a franchise-based model under which the company has a vast network of outlets called Vakrangee Kendras. Provides a range of services related to the Government of India under various e-governance initiatives.

Also Read: Bank of Maharashtra Share Price Target

Vakrangee Share Price Target Table

We, along with our team and share market colleagues, have achieved this result after doing a deep study of the shares so that you are going to know how the Vakrangee Share Price Target is going to be in the coming times. We will share with you what we have provided below.

| Year | Vakrangee Share Price Target |

| 2024 | 36.99/- |

| 2025 | 52.98/- |

| 2026 | 80.62/- |

| 2030 | 140.33/- |

| 2040 | 165.45/- |

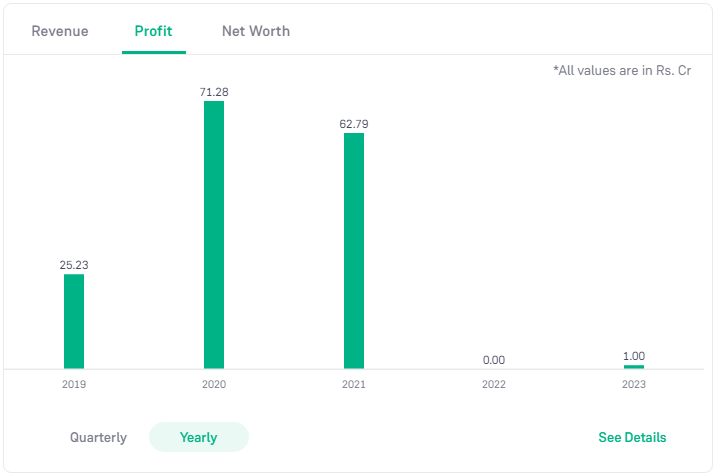

In this point, we are going to talk about the Revenue, Profit, and Worth of Vakrangee Ltd, which are the most important key points for the fundamental analysis of any stock.

So let’s first look at the fundamentals of Vakrangee Ltd, then we get to see that the company’s revenue is increasing at the rate of 1.80% as well as the operating expense is also increasing at the rate of 9.42% Also, let’s look at the net income of this company, which seems to be increasing like the previous years, which is a green signal for any investor.

Keeping all these points in mind, according to the results of the analysis done by our team, our team has set an estimated price of Rs. 36.99/- for Vakrangee Share Price Target 2024.

Also read: MFL Share Price Prediction

At this point, we are going to analyze the annual Balance Sheet of Vakrangee Ltd, from which we are going to get information about the company,

when we look at the Balance Sheet of Vakrangee Ltd, we can see that Cash and short-term investments of 259.53 million, which is currently registering a decline of 45.40%. Then we look at the total assets of the company, which is 2.98 billion, it is also seen falling at the rate of 10.60% at present.

After that comes the turn of total liabilities, which is currently 1.74 billion, in that too, a decline of 15.22% has been recorded, as well as the Price Book Ratio of this stock is also 13.85. According to this fundamental analysis, it is advisable to invest in it at present.

We will not give Rest according to your analysis, you can invest and according to our team’s analysis, our team has fixed an estimated price of Rs. 52.98/- for Vakrangee Share Price Target 2025.

Also read: SBI Share Price Prediction

At this point, we are going to talk about the Cash flow and net income of Vakrangee Ltd, from which we are going to know whether the company is earning money and whether the company has money left in its pocket or not, let us know. When we look at the company’s income chart,

we can see that the net income of the company is increasing (which is currently 10.05 million) but at the same time the cash from operations and cash from investing are continuously falling. It is visible in the minus which is -416.16 million and -51.61 million respectively and the company is also getting money from financing which is around 252.24 million at the annual rate but the company still does not have money.

When we look at the net change in cash of the company, we see the figure minus there and the same is the case with the free cash flow of the company, their figures are -215.54 million and -583.44 million, respectively. The results of this analysis Keeping this in view our team has set an estimated price of Rs. 80.62/- for Vakrangee Share Price Target 2026.

Also Read: Visesh Infotech Share Price Target

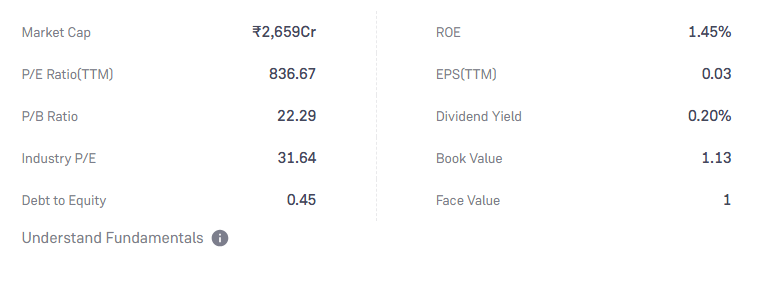

In this point, we are going to analyze the dividend and debt to equity of Vakrangee Ltd shares which play an important role in long-term investment.

So as we can see the dividend rate of Vakrangee shares is 0.20% which seems to be normal. At the same time, its equity debt is also 0.45 which proves that the company does not have any big debt so in our mind, there is a green signal to invest in this stock.

And we have set an estimated price of Rs 140.33/- for Vakrangee Share Price Target 2030.

Vakrangee Share Price Target 2040

In this point, we will talk about Vakrangee Limited, which currently falls in the category of low-cap stocks in the stock market. This stock is trading in the market with a market cap of Rs 2,659 crore.

When we look at its fundamentals, we see that at present (as of March 2024) this stock is not giving much better results as compared to previous years. If seen, based on the analysis done by our team, we saw that all three revenue, profit and net worth have come below their base.

And based on the results of our team’s analysis, Vakrangee share price target in 2040 has been estimated at Rs 165.45/-. And we hope that this stock will cross this target soon.

Vakrangee Ltd Financial Analysis

Vakrangee (Revenue)

Vakrangee (Profit)

Vakrangee (Net-Worth)

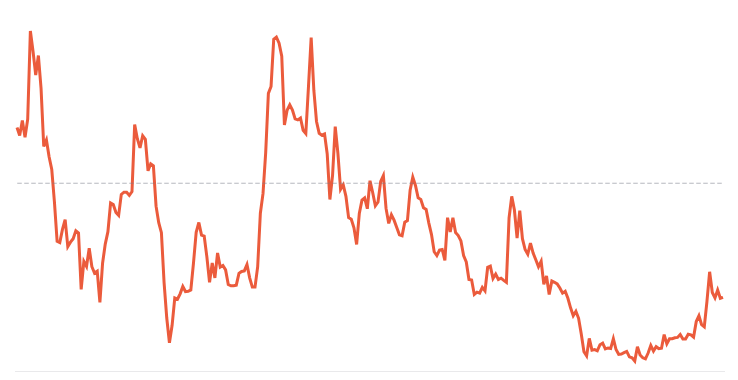

Vakrangee Share 52-Week Low-High

Vakrangee Share Price Target has reached a 52-week high of Rs 32.20/- and a 52-week low of Rs 14.44/-. You can read additional information about it here. Google Finance.

Vakrangee Ltd Share 5yr Chart

Who is the CEO of Vakrangee Ltd?

Vakrangee Ltd. The current CEO is Mr. Dinesh Nandwana, who was appointed to this position in early 2020. Nandwana, a Chartered Accountant (CA) by profession, is a well-rounded professional.

Where is the headquarters of Vakrangee Ltd?

Vakrangee Ltd. is an Indian Base Company having its Head Office established in Mumbai, India, and its address at: Corporate House, Plot No. 93, Road No. 16, M.I.D.C. Is. Marol, Andheri (East), Mumbai – 400093.

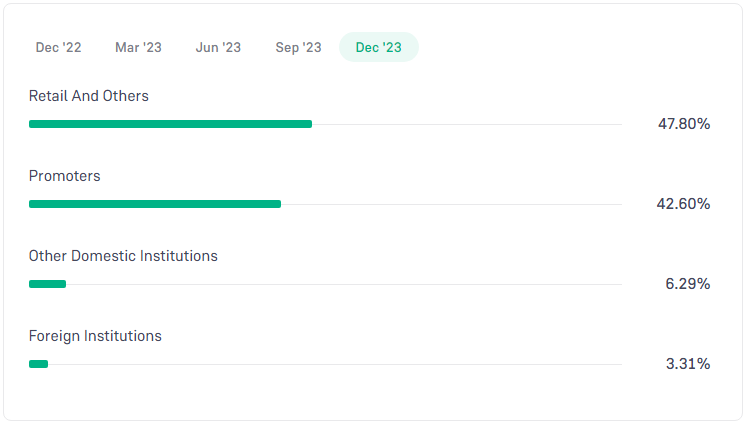

Vakrangee Ltd Share Holding Pattern

Vakrangee Ltd Share Fundamentals

Is Vakrangee a fake company

If you are searching this question on Google, then somewhere you are keeping a suspicious eye on Vakrangee Ltd. In general, every company makes some or other mistake in its time, similarly, Vakrangee Ltd has also made some mistakes, according to the sources,

we have come to know that when their auditors were asked about the company, they replied that they were not getting any proper answer/data/clarification from the company. Now it may be that everything in Vakrangee Ltd is rigged and it is also possible that Vakrangee Ltd was going to commit big fraud with its investors And all their previous balance sheets, etc.

were declared frauds. But anything can happen and when we looked at this news, we came to know that this news is 5 years old i.e. around 2018, so since then till now has the company not corrected itself?

But for the last 5 years, there have been many ups and downs in its stock, it is not that I am favouring this company, I am just putting my facts in front of you. Please check every news of the market closely before believing it.

Vakrangee Ltd F.A.Q.

what is the Demerger listing date of Vakrangee Ltd?

The demerger date of Vakrangee Ltd was 26 May 2023, on which date Vakrangee Ltd demerged with VL E-Governance & IT Solutions.

What is the Vakrangee Ltd Demerger share allotment date?

The share allotment date that was going to happen after the demerger of Vakrangee Ltd was June 15, 2023, in which its shares are about to be allotted.

What is Vakrangee Demerger Company’s name?

The name of the demerged company with Vakrangee Ltd is VL E-Governance & IT Solutions.

Vakrangee Demerger benefits.

What are the benefits for the investors of Vakrangee Ltd after the demerger of Vakrangee Ltd? So the news is that Vakrangee Ltd is going to get one share of VL E-Governance & IT Solutions in exchange for 10 equity shares, but this company VL E-Governance & IT Solutions is not yet listed in the stock market.

Conclusion

Friends, I hope you have liked this article very much and with the help of this article you will get an idea of how the Vakrangee Share Price Target is going to be in the future.

Read more STOCKseKHELO.COM

Disclaimer

This article has been written for education only. If you want to invest in any stock, then do your analysis. Take the help of an expert before investing in any stock because there is risk in every stock.

NOTE: If you want to know how to increase your CIBIL score then click on this link. How to Improve Your CIBIL Score